Cardano (ADA) recently experienced a price surge, reaching a two-year high of $1.25 before retracing to $1.01. A subsequent 15% rebound within 24 hours has sparked debate about the sustainability of this rally. A closer look at on-chain data reveals potential challenges to sustained growth.

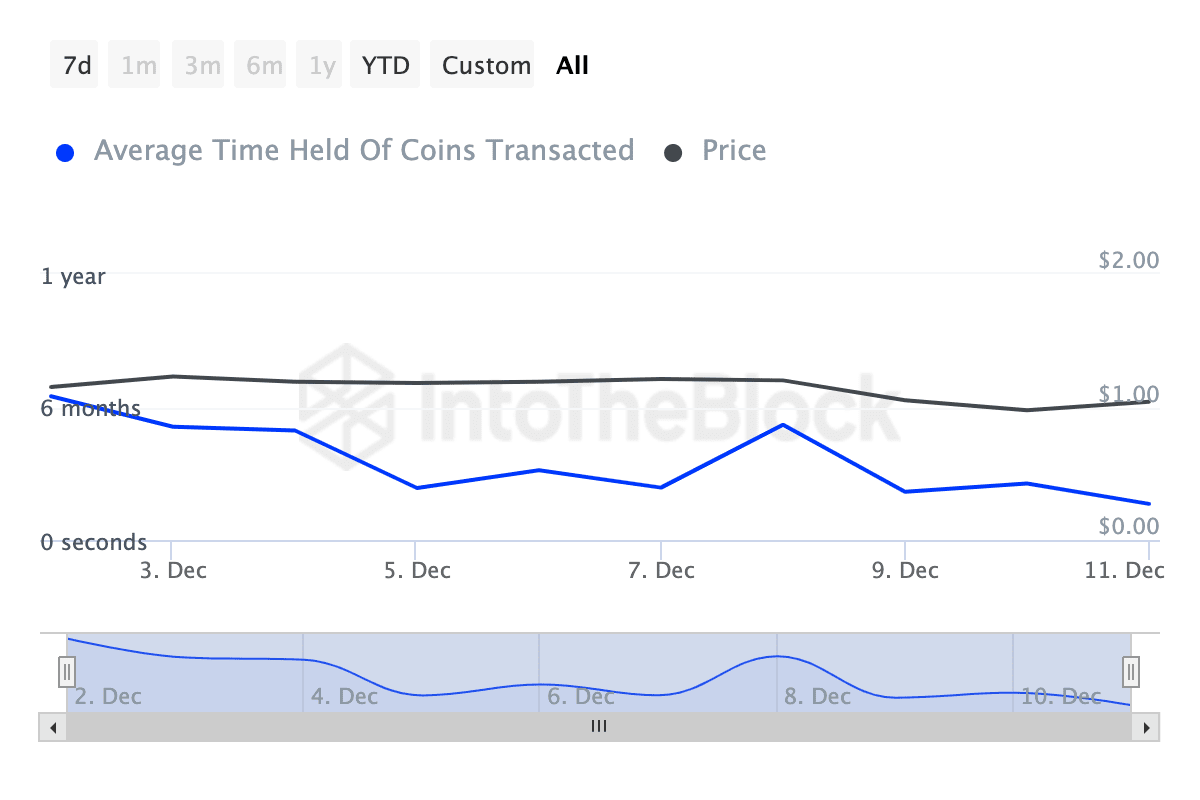

One key indicator is the significant shortening of ADA’s coin age. This suggests a decrease in investor holding times, indicating a preference for short-term trading. Such behavior is rarely conducive to long-term price support. This short-term focus contrasts sharply with the need for sustained, long-term investment to drive genuine price appreciation and establish a robust, upward trajectory.

A second significant factor is the substantial divergence between ADA’s price and its daily active addresses (DAA). A massive 134.26% drop in this correlation signifies that the recent price increase hasn’t been accompanied by a corresponding rise in active users. This lack of organic growth in active participation points towards a speculative, rather than fundamentally driven, market rally, highlighting the risk of an impending correction.

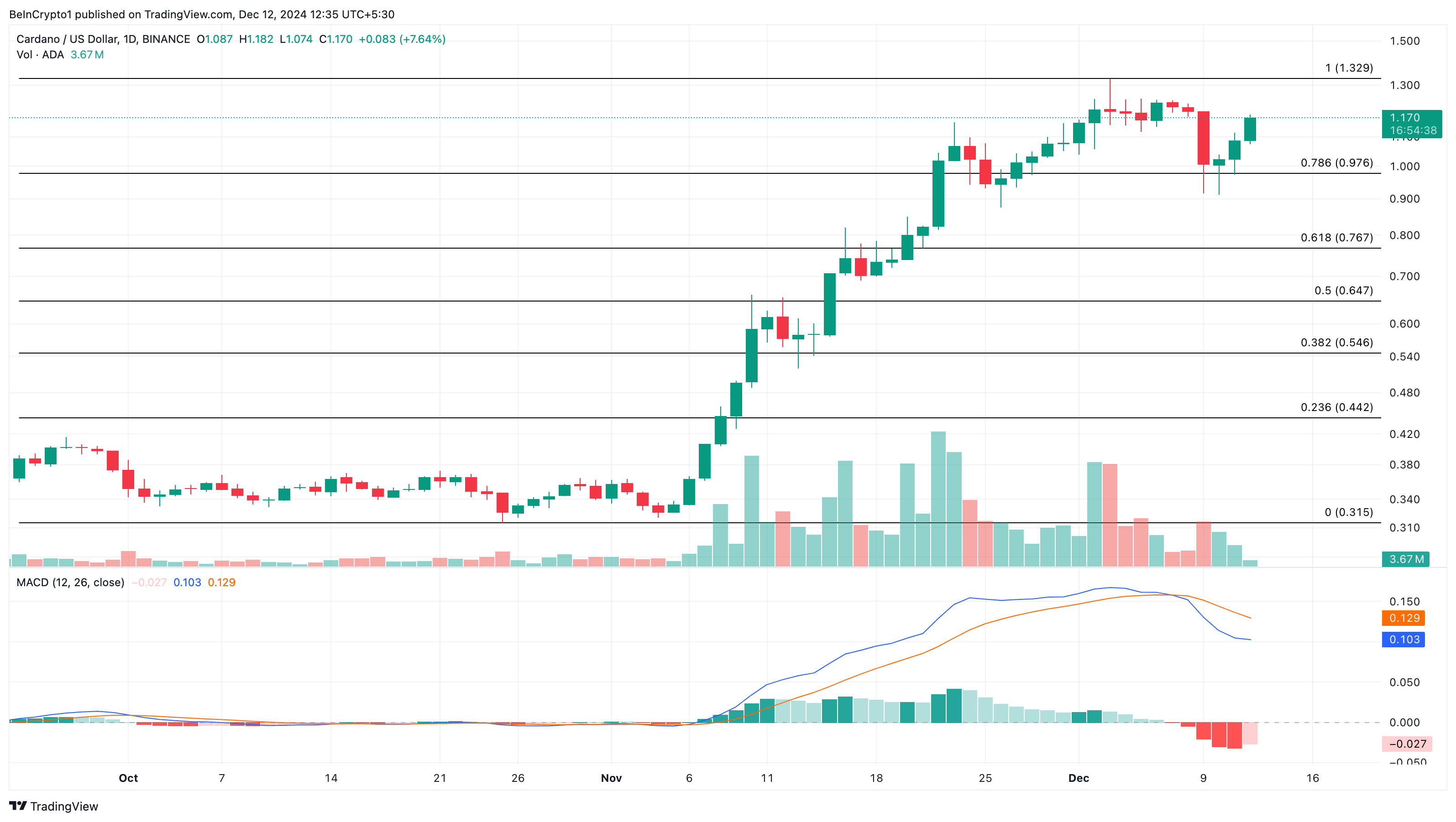

Technical analysis further supports this cautious outlook. The MACD (Moving Average Convergence Divergence) indicator currently shows a negative value, a clear bearish momentum signal. This negative reading underscores the lack of buying pressure and reinforces the possibility of a downward trend.

Considering the aforementioned factors—shortening coin age, the drastic divergence between price and DAA, and the bearish MACD signal—a price correction towards $0.98 seems likely. However, this prediction is not immutable. A shift in market sentiment, coupled with the emergence of sustained buying pressure, could propel ADA’s price to $1.33 or even $2. Such a scenario would require a significant influx of new investors and a convincing narrative capable of attracting long-term holders, a considerable shift from the current short-term trading dominance. The coming weeks will be crucial in determining whether this rally represents a temporary blip or the start of a more substantial upward trend. Continued monitoring of on-chain metrics, alongside technical indicators, will be vital for navigating this volatile market.

Leave a Reply